- #GEMINI EARN TURBOTAX HOW TO#

- #GEMINI EARN TURBOTAX SOFTWARE#

- #GEMINI EARN TURBOTAX PROFESSIONAL#

- #GEMINI EARN TURBOTAX FREE#

#GEMINI EARN TURBOTAX FREE#

Get started with a free preview report today. Import your gains and losses with a click: Once you’ve imported your crypto transaction history and generated your crypto tax reports within CoinLedger, you’ll be able to import them directly into TurboTax and other tax platforms with the click of a button! If you need assistance at any point while using CoinLedger, our support team is ready and available for all of our customers via email and live chat. Get the support you need: We know that trying to report your taxes on your own can be difficult. Highly capable: CoinLedger integrates with hundreds of exchanges and wallets such as Coinbase, Kraken, and Gemini and blockchains such as Ethereum and Solana.

#GEMINI EARN TURBOTAX SOFTWARE#

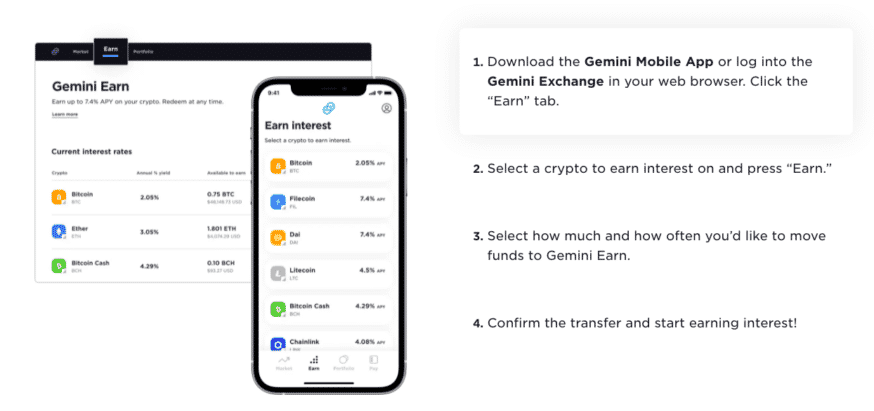

Looking for the best crypto tax software to use with TurboTax? Here’s why you should choose CoinLedger. Just connect your wallets and exchanges and CoinLedger can generate an aggregated crypto tax report that you can easily import into TurboTax! What’s the best crypto tax software to use with TurboTax? In this case, TurboTax will have trouble calculating your capital gains and losses as it lacks the ability to track transfers between wallets and exchanges. Both Premier and Self-Employment support cryptocurrency tax reporting. Head to TurboTax Online and select your package. Navigate to TurboTax Online and select the Premier or Self-Employment package Here’s how you can report your cryptocurrency within the online version of TurboTax.

#GEMINI EARN TURBOTAX HOW TO#

How to enter crypto gains and losses into TurboTax Online This is why TurboTax has partnered with CoinLedger to help users aggregate crypto transactions across all of their wallets and exchanges and then import relevant tax forms directly into their TurboTax account. As a result, it doesn’t always have the integrations and functionality needed to make reporting your crypto taxes stress-free. While TurboTax is one of the best tax platforms on the market, it’s important to remember that it wasn’t built with cryptocurrency in mind. Yes, TurboTax allows users to report cryptocurrency taxes. Can I file cryptocurrency taxes on TurboTax?

#GEMINI EARN TURBOTAX PROFESSIONAL#

Most countries allow you to self-declare taxes online in 2023, but you can also get help from a professional tax accountant to file taxes for you.In this guide, we’ll walk through a step-by-step process to report your bitcoin and cryptocurrency on TurboTax-both online and desktop versions. Luckily, Coinpanda can help you with this and generate ready-to-file tax forms quickly and easily.Īfter downloading your Gemini tax statements from Coinpanda, the last step is to report the capital gains and income on your tax return before the deadline. Once you have this data, you can calculate your capital gains or losses by determining the price at which you bought the cryptocurrency (your cost basis) and the price at which you sold it (your proceeds). To calculate your capital gains, you must first export a complete history of all transactions made on Gemini. When you have this information ready, you can report capital gains and income together with other forms of income such as employment and dividends in your annual tax return. How do I file my Gemini taxes?įirst, you must calculate capital gains and income from all taxable transactions on Gemini. To learn more about how Gemini transactions are taxed in your country, we recommend reading our in-depth guides to cryptocurrency taxes.

On the other hand, if you sell the cryptocurrency for less than you paid initially, you have a capital loss, which can offset other gains in most cases.

The exact tax implications on Gemini transactions depend on which country you live in and the type of transactions you have made. Coinpanda also supports XLSX files with your Gemini Earn transactions.

0 kommentar(er)

0 kommentar(er)